MSIV Invests in Mill Valley’s OLarry

Q&A with Founder & CEO Eric Rachmel

Wednesday, August 6, 2025 from Mill Valley, CA

In 2021, Marin Sonoma Impact Ventures launched the North Bay’s first regional venture capital fund and began deploying capital into Marin + Sonoma’s most promising startup companies.

Today, we are excited to share details around our investment in OLarry, a startup reimagining the traditional CPA firm by providing customers unlimited access to tax advice, filings, and strategy supported by modern technology.

OLarry is extending a level of expertise and service previously accessible only to the ultra-high net worth to a greater number of Americans. Their vision is to leverage AI and best-in-class technology not to replace the high-touch service model but to accentuate it, freeing up CPAs to spend more hands-on time with their clients rather than on rote, repetitive tasks ripe for automation.

Why We Invested

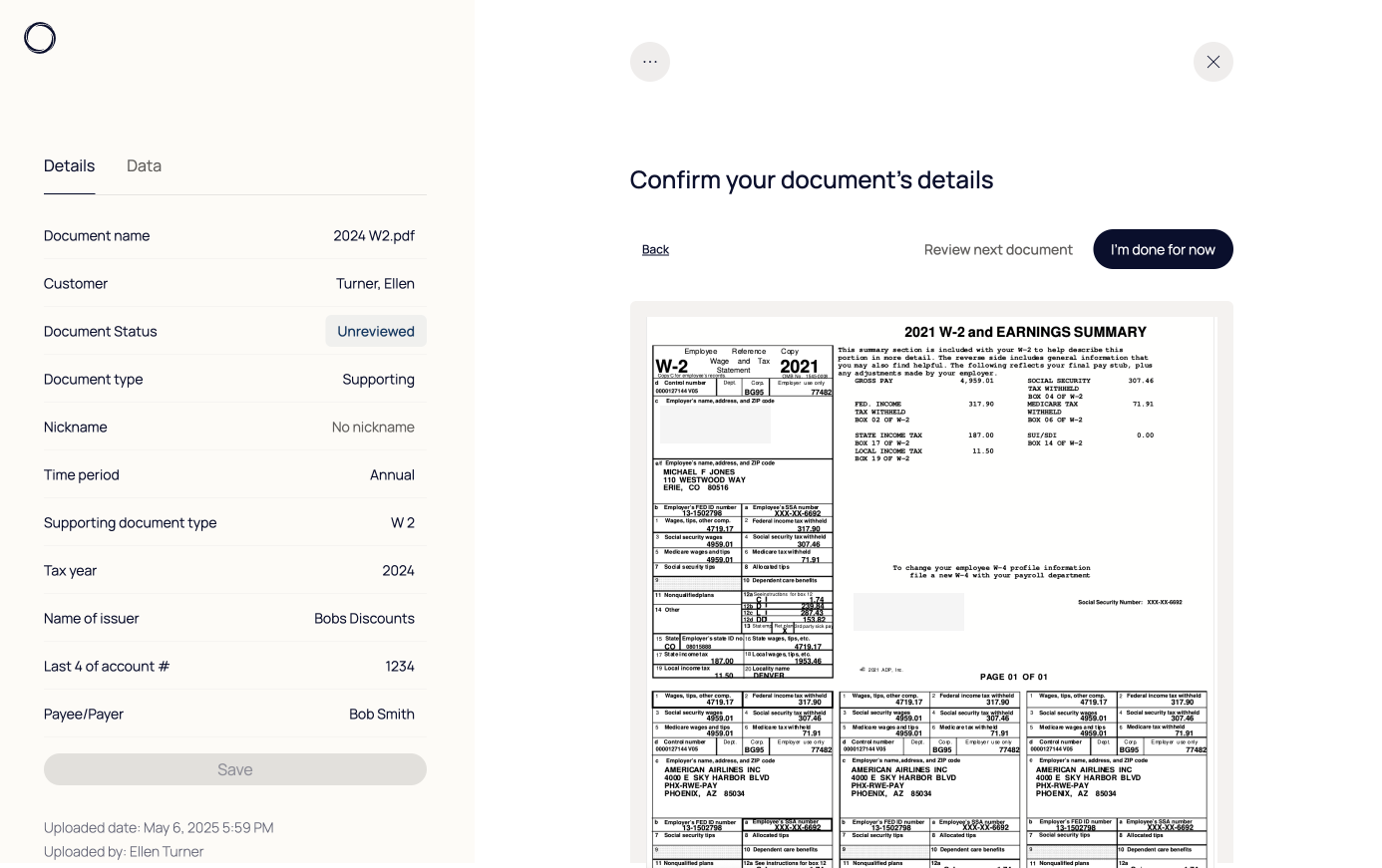

The July passage of the 2025 OBBBA tax reform law is the latest reminder of the ever-evolving complexity of the U.S. tax code. With more Americans having tax filing needs that go beyond a straightforward W2 income stream, sophisticated CPAs are needed to help individuals and small businesses navigate tax season.

Yet, 75% of CPAs at the partner level are expected to retire over the next 10-15 years and too few graduates are entering the profession – we saw a 17% decrease in accountants and auditors between 2020 and 2022. At the same time, private equity is rolling up many boutique firms, which may be an attractive business play but one that is unlikely to improve client service. Moreover, 93% of clients now expect advisory services from their CPAs, and paying for that hourly is an unappealing option for most.

OLarry’s approach is different. They are building a best-in-class back-end complete with automation and integrations so their CPAs can spend more time with clients and less time manually parsing 1040 forms. Their annual subscription model means clients can tap their CPAs for advice at any time without being charged extra, similar to how many clients already work with their wealth advisors.

OLarry Founder & CEO Eric Rachmel is a former venture capital investor who previously founded and led mortgage servicing startup company Brace, which exited in 2023. His journey in launching OLarry is deeply personal, and MSIV is joining leading fintech investors in a $10 million Series A round that OLarry announced on August 5.

Less than two years after launching, OLarry already counts 2,000+ individuals, 700+ businesses, and 250+ estates and trusts as clients.

MSIV Founder & Managing Partner Zachary Kushel sat down with OLarry Founder & CEO Eric Rachmel to discuss the evolving landscape in the tax advisory space and his vision for building the next-generation CPA firm.

OLarry CEO Eric Rachmel

ZK: Eric, where did the inspiration come from for you to launch OLarry?

ER: This is deeply personal for me. In 2022, when I was leading my last startup company Brace, which sold mortgage servicing software to large banks, my dad got sick from COVID and passed away over the summer. He ran a CPA firm in southern California, and it was my responsibility to ensure continuity for his clients and employees. So I put on a second CEO hat for a bit and was able to steer the firm through that transition and ultimately to a sale, and in doing so, I got to look under the hood of how a typical CPA firm operates.

Eric with his daughter and late father Larry

These are firms that generally have 30%+ net income positive margins despite minimal digital presences – their websites are little more than landing pages and many still store documents in places like server rooms. When Brace exited in 2023, I was reflecting on my path forward, and I kept coming back to the juxtaposition between the impersonal nature of my startup client relationships and the bonds my dad had built. When he passed, I had dozens of clients coming in and sharing hugs and stories – it was so deeply personal in every way my previous business was not.

I concluded there was a clear opportunity to digitize to make the CPA customer experience even better, and I decided to launch OLarry to tackle this challenge and named the company after my late father.

ZK: That is such an incredible founding story. Can you share a bit more about the product vision for OLarry and how you differentiate your offering?

ER: We are leading a push for clients, both individuals and business owners, to be more proactive around tax planning. My personal experience was I would reach out to my accountant in March, share with them some documents, and they would spit out a result. But they are inundated at that time of year so have little time to talk and truly understand what my true needs were. Core to our offering is an unlimited flat-fee service model so clients are incentivized to plan and ask questions throughout the year, whether they’re buying a home or doing stock comp planning around exercising.

From the CPA’s perspective, they are historically bogged down with data entry during the peaks of tax season, so we’re leveraging AI and sophisticated software to strip out most of that data entry and have software do the heavy lifting. The CPAs then become reviewers rather than doers, and it frees up their time to give thoughtful, strategic advice that they previously had no time to consider. We have no interest in automating away the client-advisor relationship – instead, we are removing CPAs from rote work so they can spend their time maximizing value to their clients as trusted advisors.

ZK: You chose to build a services firm rather than sell software to existing CPA firms – can you share more about why?

ER: With AI, I had high conviction that building a vertically integrated business was the right move. The profit margins in this space are attractive, and we have an opportunity to leverage tech to support a better experience for both CPAs and clients. With fewer graduates entering the profession, and private equity rollups, there will be fewer firms to sell to while demand for tax advisory is exploding.

It was imperative to bring to market a tech-enabled services firm and deliver a fully integrated solution to solve this problem for a growing number of people and in the process make OLarry a destination for CPAs who wish to deliver high-touch service supported by the best-in-industry back-end.

ZK: Can you introduce yourself to the community as their North Bay neighbor? What are you up to when you’re not running OLarry?

ER: I’m a new arrival to Marin, having relocated to Mill Valley with my wife and daughter in January 2024. We are expecting our second child in October, and have a new puppy that’s 10 weeks old, so we certainly are keeping busy. I first discovered the North Bay in my 20s when I was living in San Francisco and really fell in love with this community. I previously built Brace from Los Angeles, but given the opportunity to build this new business, we proactively chose Marin where we wanted to settle down and build our family and business.

Eric and his daughter walking on Marin’s Horse Hill

ZK: What excites you about the potential of the growing Marin + Sonoma startup community? How can prospective clients and CPAs benefit from what OLarry is offering?

ER: I’m excited to partner with MSIV and have been intrigued about the potential of the Marin + Sonoma startup community ever since our first meeting over a year ago. We want to serve this community and grow our presence here. We’re pleased to connect with local business owners and individuals with growing tax complexity to see if our services can address their needs.

I’m also eager to build out a physical presence to serve local clients. We have already acquired two Bay Area CPA firms to date, and we are very actively searching for a North Bay firm to bring into the fold that would allow us to accelerate our emerging local presence. For technology-forward CPAs looking for new opportunities, we’re also actively hiring and would love to talk to you about being part of our effort and serving clients in the community where you live.